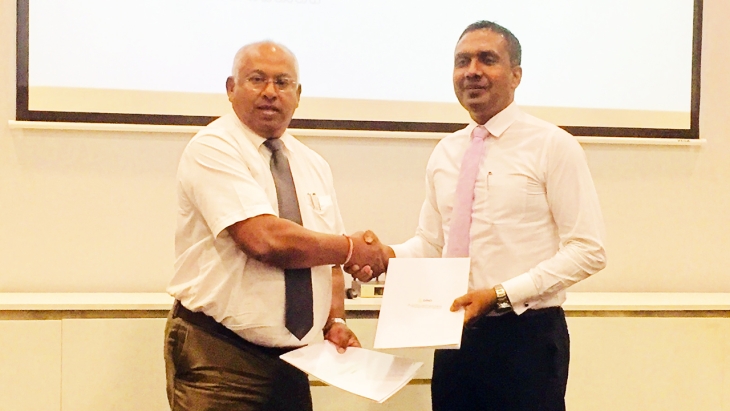

Sarvodaya Development Finance PLC (SDF) has entered into a special MOU with DIMO to provide attractive leasing rates and low down-payments exclusively to the agricultural sector, through a special finance scheme, for the 3rd consecutive year, along with a host of other exclusive benefits. This partnership will position SDF as the preferred financial partner for new and existing customers looking to finance all Mahindra and Swaraj tractors and Lovol and CLASS Combined Harvesters imported and sold by DIMO to its customers for agricultural purposes. A buyback-offer from DIMO, for the tractors sold by SDF, under certain conditions, is another attractive and valuable benefit created by this partnership, which was initially entered into in 2019 and has since been extended annually, this year for a 3rd time. The MoU formalizing the partnership was signed recently at a small ceremony with top officials from both SDF and DIMO present.

In addition to lower rates, new and existing SDF customers who obtain leases under the above partnership and special finance facility will also enjoy benefits such as a comprehensive 2-year warranty for the products, along with a further 4-year extended warranty for Mahindra and Swaraj tractors. Combined Harvesters will enjoy a comprehensive 1-year warranty period. In addition to these benefits, customers will also receive a free Farmer KIT and free oil filters, coupled with three (03) services provided free of charge. Additionally, Combined Harvesters will enjoy free GPS devices added at no cost. In order to further support the agricultural sector, customer visits will also be conducted to better educate customers and share knowledge.

Discussing the partnership, Mr Nilantha Jayanetti – CEO at SDF said, “We’re pleased to announce the further extension of this valuable partnership. Despite the fertilizer issue and other challenges in the agricultural sector, we have been able to deliver consistent and continuous growth in terms of our agricultural vehicle/equipment leasing portfolio. Operating amidst a subdued market environment, we have still continued to deliver growth and value to both our customers and investors, emerging as their preferred financial partner. Through our lending activities, particularly leasing, we are positively contributing to the productive economy and the agricultural sector by providing the right financial solutions for stakeholders of that sector, 80% of whom are outside the Western Province. Backed by the Sarvodaya Movement, SDF is more than a finance company, we provide an alternative economic model, directly encouraging and supporting our customers to uplift their own local economies, which ultimately contributes to the national economic output.”

SDF is among a handful of finance companies in Sri Lanka that are continuing to outperform, despite external challenges. Earlier in January 2022, the Company released robust financials for the 1st nine months of FY 2021/22, recording a remarkable 48% growth in PAT, amidst a challenging market environment. The Company’s portfolio also demonstrated double-digit growth, bucking the industry trend for negative portfolio growth, due to local and global challenges. These figures were announced the wake of SDF’s highly successful IPO, which was heavily oversubscribed.

With an island-wide presence, the Company is a leader in Development financing in Sri Lanka, particularly for agricultural sector SMEs including emerging markets in the North and East. SDF has also been awarded as the Fastest Growing Development Finance Company in Sri Lanka by Global Banking and Finance Review, UK 2021.