The Vehicle Importers Association of Sri Lanka (VIASL) said that the taxes on vehicles can go up to Rs 600 in some cases and some vehicles are subject to taxes as high as 400% or 500%.

Addressing the media, the VIASL Chairman explained that although the government issued a gazette notification, it only mentioned the percentages of excise duty imposed on vehicle imports.

The final cost of a vehicle is determined after calculating multi-tiered taxes including special import duty based on vehicle value, luxury tax, customs duty, cost, insurance and freight (CIF) and existing 18% VAT.

Therefore, the VIASL chairman asked the public not to panic and clarified that the taxes mentioned in the recent gazette notification do not represent the final vehicle tax imposed by the government. He also advised not to make advance payments or vehicle bookings before starting the import of vehicles.

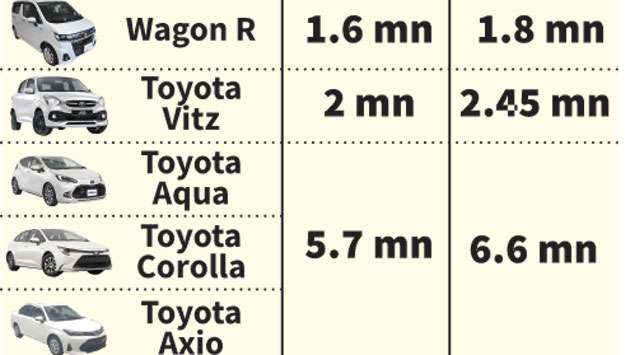

Several non-petrol-hybrid vehicle categories are listed, including models from Suzuki, Toyota, Honda, Nissan, Mitsubishi and Mazda. Under Suzuki, each is priced at Rs 1.3 million, while the Spazia and Alto are priced at Rs 1.9 million each. Toyota’s lineup includes the Tiss and Yaris at Rs 2.4 million, the Corolla at Rs 2.4 million. 6.6 million and CHR for Rs.4.6 million. Honda is offering N-BOX, N-ONE and N-WGN cars for Rs 1.9 million. Nissan is offering the Dayz at Rs 1.9 million and the Clipper NV100 at Rs 1.3 million. Mitsubishi lists Minicab cars at Rs 1.3 million and Mazda offers Scrum cars at the same price.

For petrol hybrids, Suzuki offers the Wagon R, Spacia and Hustler at Rs 1.8 million and the Swift at Rs 3.2 million. Toyota’s hybrid models include Raize at Rs 3.2 million, Axio and Aqua at Rs 5.1 million and Yaris (Cross), Corolla Fielder and Corolla (Cross) at Rs 5.1 million. Corolla and Prius cars are available for Rs 11.3 million. Honda is offering Fit cars for Rs 10.3 million. 3.5 million, a Vezel for Rs.5.1 million and an N-BOX, N-WGN, N-ONE, and Shuttle for Rs.1.8 million each. Mazda’s hybrid options include both the Carol and the Flare, both priced at Rs 1.8 million.

Following the resumption of vehicle imports after a five-year suspension, a gazette notification was issued to impose the excise duty rates with effect from January 11, by the President as Minister of Finance and Economic Development.

Accordingly, excise duty of 200 percent and 300 percent has been imposed on vehicles less than 10 years from the date of manufacture. Certain categories of vehicles are subject to excise duty based on their engine cylinder capacity, motor power measured in kilowatts and year of manufacture.