The central bank conducts weekly T-bill auctions, raising Rs 107.0 billion, the total amount offered is fully accepted across all maturities.

Among the total bids received for the three kalpirams, the last six-month T-bill attracted the highest interest, equal to the T-bill. Meanwhile, weighted average yield rates fell across the board for the sixth straight week at T-bill auctions. The three-month commodity issue closed at 8.33 (-14bps), six-month commodity issue at 8.44 (-16bps) and one-year commodity issue ended at 8.80 (-10bps).

In the modern session, secondary market yields witnessed neutral commodities, while in the post commodity issue auction, the three-month and six-month commodity issues traded at 8.25 per cent and 8.35 per cent respectively. Among the maturities traded, short-term 2026.02.01 and 01.06.26 and 01.08.26 bonds traded in the range of 9.15 to 9.00 shots, while 2027.09.15 and 15.10.27 bonds traded in the range of 9.85 to 9.80 shots.

Also, at half-time of business, 15.03.28 Mid Page traded in the range of 10.20 to 10.10, and 01.05.28 and 01.07.28 traded in the range of 10.38 to 10.26. As of the lower half, 15.10.28 and 15.12.28 traded in the range of 10.45 to 10.40 vision.

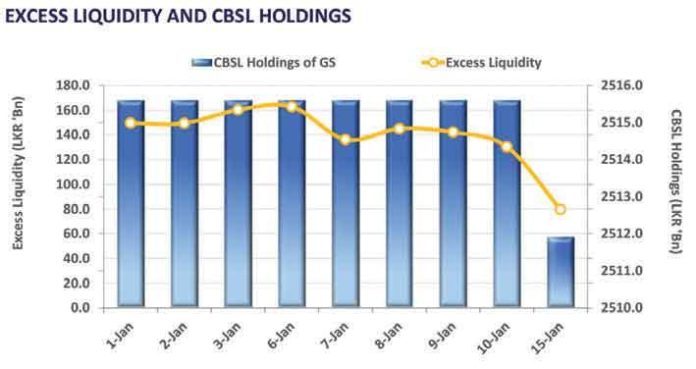

From the external sector, the Sri Lankan Rupee against the United States Dollar was Rs. 294.6/US dollar, compared to the previous day’s Rs. 295.6/USD ended the loss. The central bank’s government securities fell to 2,511.92 million. Bank overnight liquidity recorded on the previous day was Rs. 130.26 to Rs. contracted to 79.61.