Confidence in the stability of Sri Lanka’s financial system has improved in the first half of 2025, according to the latest Systemic Risk Survey conducted by the Central Bank of Sri Lanka (CBSL). The survey results, based on responses from 136 financial sector institutions, reflect a more optimistic outlook compared to previous rounds.

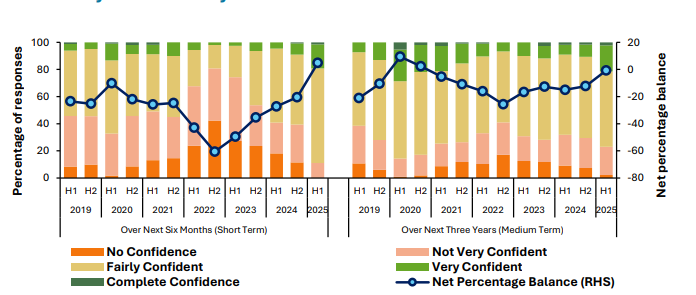

The findings indicate a decline in the perceived probability of a negative high-impact event affecting the financial system, suggesting a shift in market sentiment towards greater stability. Respondents reported higher levels of confidence, particularly over the short and medium term.

Despite the improvement in sentiment, ‘Domestic Macroeconomic Risks’ remain the top concern among financial institutions. However, the weight given to ‘General Risks’ has lessened, attributed to the easing of political uncertainties in recent months.

The survey, conducted biannually by CBSL’s Macroprudential Surveillance Department, gathers insights from risk officers across banks, finance companies, leasing firms, insurers, fund managers, brokers, and rating agencies. It tracks perceptions of systemic vulnerabilities across six broad risk categories: global and domestic macroeconomic risks, risks related to financial infrastructure and institutions, financial market risks, and general risks.

While domestic risks continue to dominate the risk landscape, the survey notes a steady reduction in the average weighted probability of crisis scenarios. This marks a positive trend, continuing from previous survey rounds in 2023 and 2024.

The CBSL emphasises that these results reflect the views of market participants and not the official stance of the Central Bank.

The Systemic Risk Survey serves as a key tool for the Central Bank to monitor risk perceptions in the financial system and to inform macroprudential policy responses.