Sri Lanka’s ongoing debt crisis is not just a result of poor governance—it is deeply linked to what international activist and academic Eric Toussaint calls the global “debt system,” a structure that has trapped countries of the Global South in cycles of dependency and austerity.

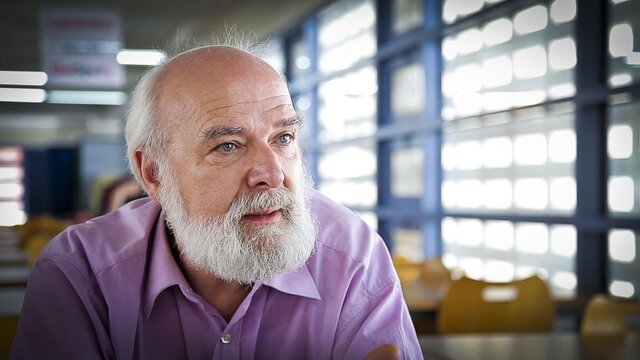

Toussaint, a founding member of the Committee for the Abolition of Illegitimate Debt (CADTM), is currently in Sri Lanka, holding discussions with civil society groups, academics, and trade unionists.

In a compelling conversation broadcast on Satahan Radio, Toussaint, alongside Sri Lankan academic and activist W. Singham Kumar, explained how institutions like the International Monetary Fund (IMF) are not neutral lenders, but political actors that shape national policies in the interest of global capital.

“This is not just about economics. Debt is a political tool. And in Sri Lanka, it is being used to dispossess people of their rights, wealth, and future,” Toussaint said.

Sri Lanka and the IMF: A Costly Relationship

Sri Lanka’s relationship with the IMF dates back to 1965, but it has intensified since the country’s adoption of open economic policies in 1977. The current agreement—Sri Lanka’s 17th with the Fund—was signed in 2023 amidst an unprecedented economic collapse. Inflation soared, foreign reserves vanished, and the country defaulted on its external debt for the first time in history. The government turned to the IMF, securing a $3 billion bailout package with a series of conditional reforms.

These conditions include increases in value-added tax (VAT), removal of energy subsidies, reduction in public sector spending, and privatisation of state-owned enterprises. As Kumar pointed out, “This is the same script we’ve seen before—every IMF agreement promises growth, and every time the outcome is more suffering for the working class.”

Toussaint drew attention to the fact that Sri Lanka’s debt burden has risen, not fallen, under successive IMF programmes. “If these loans actually worked, Sri Lanka should be better off by now. Instead, each agreement makes the country weaker and more dependent,” he said.

Illegitimate Debt: What It Means and Why It Matters

A central focus of the discussion was the concept of illegitimate debt—debt incurred without public benefit, often under corrupt or coercive conditions, and used to enrich elites or serve geopolitical interests. “We are not against all debt,” Toussaint clarified. “We are against debt that is accumulated against the interest of the people and in favour of a privileged few.”

Sri Lanka’s borrowing for white elephant infrastructure projects—such as the Hambantota Port, Mattala Airport, and expressways—was raised as key examples. “These mega-projects were sold as development, but they have drained public finances and displaced communities. Who benefits from a port no one uses, or an airport with no planes? Not the people,” Kumar said.

Toussaint noted that much of the IMF and World Bank’s lending does not even go towards building infrastructure. Instead, it supports “policy-based lending,” whereby loans are given to implement structural reforms like privatisation, deregulation, and retrenchment of workers—actions that have long-term negative impacts on national development and social equity.

The Global Debt Trap: A System Designed to Fail

In tracing the history of global debt, Toussaint explained that lending has often been a means of control. From colonial conquests justified through debt claims in Egypt and Tunisia in the 19th century to post-World War II IMF and World Bank operations, the pattern is consistent. “Debt has always been used by global powers to extract resources and impose political conditions. It’s a modern form of colonialism,” he said.

Toussaint shared his own journey from activism in Latin America to founding CADTM in Belgium, and described successful debt audits he helped lead in countries like Ecuador and Greece. In Ecuador, a people’s audit led to the cancellation of illegitimate debt to Norway, and the leftist government of Rafael Correa even expelled the World Bank’s representative.

“In Greece, after the 2008 crisis, we exposed how European banks used IMF loans to bail themselves out, while imposing brutal austerity on the Greek people. These examples show that resistance is possible,” he said.

Sri Lanka’s Path Forward: Moratorium, Audit, and Mass Mobilisation

Toussaint argued that Sri Lanka has a strong legal and moral case to suspend debt repayments. “The economic collapse of 2022 was not purely domestic—it was worsened by external shocks like the COVID-19 pandemic, the war in Ukraine, and rising global interest rates. These constitute a ‘fundamental change of circumstances’ under international law,” he said. “Sri Lanka has the right to declare a moratorium and conduct a public audit of its debt.”

However, he cautioned that such measures are not simple acts of policy, but outcomes of political struggle. “You cannot just ask the IMF nicely to leave. You must build a movement powerful enough to force the issue, and to support any government that is willing to stand up for its people.”

Kumar added that while Sri Lankans mobilised in 2022 to oust a corrupt regime, the deeper system that enables economic injustice remains intact. “We need to expand our understanding. Corruption is not just local—it is structural and international. The IMF, the bondholders, the local elites—they are all part of this.”

BRICS, China, and the Mirage of Alternatives

The conversation also touched on the popular perception that China and the BRICS countries might offer a more just alternative to the IMF. Toussaint was blunt: “The BRICS do not represent a new model. China’s lending is driven by the same extractive logic—securing raw materials and trade routes. The loans may come without the same conditionalities, but the outcome is still dependency.”

He noted that the final declaration of the 2024 BRICS summit reaffirmed the central role of the IMF in the global financial system. “They are not building an alternative. They are reinforcing the existing order.”

The session concluded with a call to reframe the debt debate—not as a technical matter, but as a question of justice. “This is not just about budgets and balance sheets. It’s about lives, livelihoods, and dignity,” Toussaint said. “Debt cancellation is not charity. It is a demand for justice.”

As Sri Lanka prepares for the next phase of its economic recovery, the challenge now is whether its people and leaders will accept IMF prescriptions as inevitable—or organise for a different future. One thing is clear from Toussaint’s message: “The struggle against illegitimate debt is a global one. And it begins with the courage to say no.”

BY Methmalie Dissanayake